Specialist heavylift shipowner wins a victory over its estranged partner in arbitration and in the courtroom

Date published: 8 September 2021, by Bob Rust, in New York

A Hong Kong judge has rebuffed a Chinese state-owned company called only “plaintiff Z” in its bid to set aside an arbitration that went in favour of a private shipowner called only “defendant R”.

The fight was over a shipowning joint venture between Red Box Energy Services and ZPMC Group that went sour.

A recent 9,000-word ruling by judge Mimmie Chan of the Hong Kong High Court reduces all parties, vessels and shipping projects to their initials. But a few unredacted details make it clear that victory belongs to Philip Adkins-led Red Box, a Rotterdam-based heavylift shipowner, which established itself recently as a Singapore corporation.

“I’m quite happy to confirm that your reading is spot on,” Adkins said.

The loser in the case is Shanghai-based container crane manufacturer and shipowner ZPMC, a major Chinese state-owned enterprise (SOE).

The decision illuminates ZPMC’s much reported but still murky manoeuvres to enter high-end project shipping, first through the Red Box tie-up and then through a venture with rival GPO Heavylift.

Adkins told TradeWinds: “For seven years they tried to destroy everything we created. The lesson for ZPMC is that when you decide to play a zero-sum game, it’s important to understand the consequences if you lose.”

The recent decision does not spell out those consequences, but a further court ruling is expected soon.

Officials of ZPMC did not respond to email enquiries.

Today the former ZPMC-Red Box joint venture’s chief assets, the 28,900-dwt ice-breaking heavylift carriers Pugnax and Audax (both built 2016), are in the hands of Adkins’ team.

TradeWinds reported in May that CSSC Finance, the lease finance affiliate of China State Shipbuilding Corp, repossessed the vessels from the venture. It then sold them at auction to Adkins’ new Singapore-based Red Box for just over $130m, and then bought them back under a deal that involves a three-year charter to Red Box with a purchase obligation.

Wary of state-owned partners

The doomed partnership was one through which ZPMC had hoped to enter a higher-margin segment of the heavylift shipping market. For his part, Adkins had sought low-cost capital despite what he described a wariness about partnering with a Chinese SOE.

ZPMC, originally Zhenhua Port Machinery Corp, has assembled over many years a large captive fleet of heavylift vessels, mostly converted in its own Zhenhua Heavy Industries shipyard, to deliver its cranes worldwide. To optimise utilisation, the company also books opportunistic backhaul cargoes.

Red Box, as Adkins’ team has been known since their early days at Rotterdam-based Fairstar Heavy Transport, represents the opposite and higher end of heavylift, focusing on high-specification, purpose-built tonnage to serve multi-voyage time charters, typically for LNG projects.

The Red Box team was on hold from 2012 to 2014, after Dockwise won the Fairstar fleet in a hostile takeover. But after a non-compete agreement had expired, Adkins and 15 other Fairstar veterans teamed up with ZPMC in a headline-making deal.

A Hong Kong subsidiary of ZPMC and an Adkins-led entity called only RBF were 51% and 32.5% shareholders, respectively, in a joint venture called ZPMC-RBES, alongside another mainland partner. It traded under the more pronounceable branding ZPMC-Red Box.

Under the 2014 shareholder agreement, major partner ZPMC was to continue to carry its proprietary cargoes, but agreed to stay out of multi-voyage time-charter tenders. When suitable tonnage was available to the joint venture, either owned or bareboat chartered in, ZPMC was to bow out.

Rivals and partners

In 2016, the joint venture took delivery of the Pugnax and Audax, each capable of carrying two 10,000-tonne LNG liquefaction modules at a time. But in 2017, ZPMC made headlines by taking a 50% stake in a second heavylift owner, Taiwan’s GPO Heavylift, with a fleet built for the same jobs.

Red Box told the arbitration panel that ZPMC offered GPO Heavylift tonnage for three major tenders against the joint venture.

Much of the ruling centres on a May 2018 tender for a project known as Yosemite. This is believed to be the vast ethylene plant built near Corpus Christi in Texas by ExxonMobil and Saudi Arabia Basic Industries Corp.

RBF initiated its Hong Kong arbitration in July 2019, leading in November 2020 to arbitration awards against ZPMC by arbitrators Roger Stewart, Richard Field and Allan Myers.

Full award documents are not publicly available, but judge Chan’s recital of their contents makes it clear that the panel found ZPMC in material breach of the shareholder’s agreement, and the judge backed the panel over ZPMC’s objections. (Copyright)

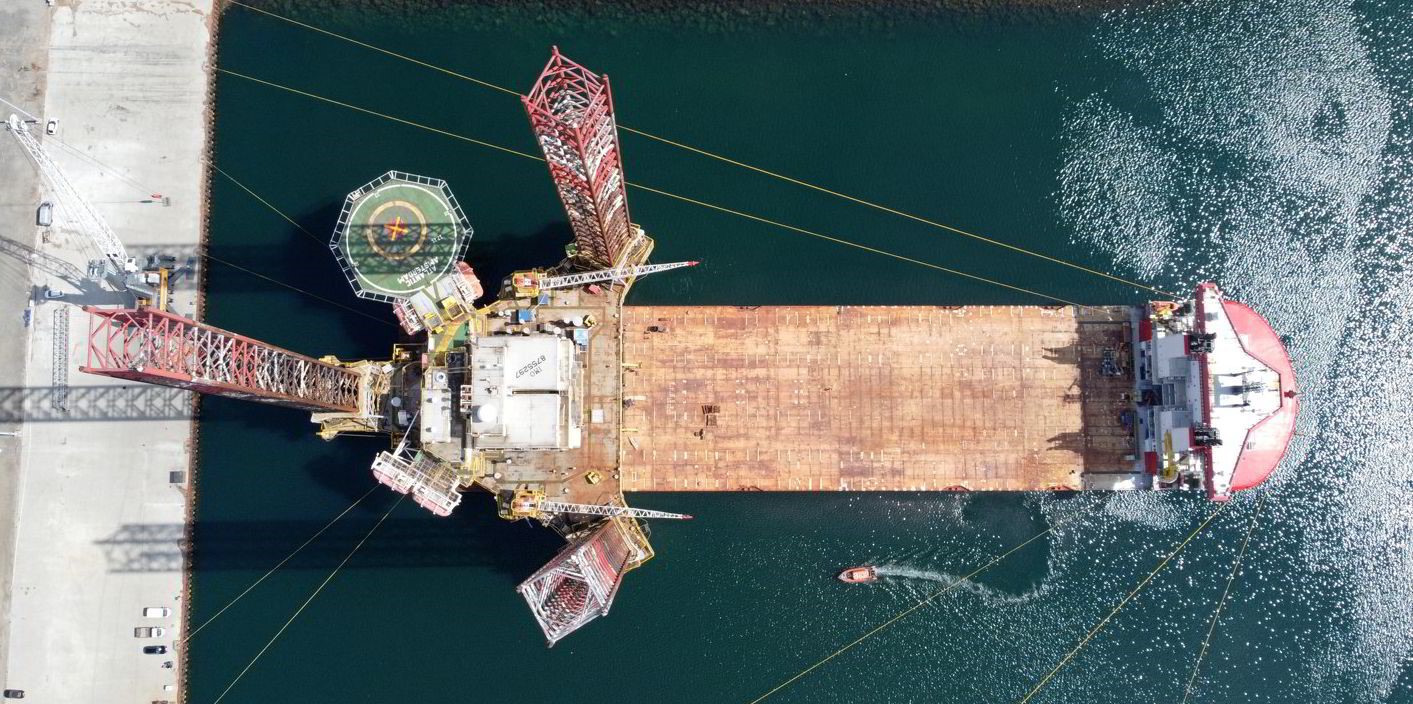

Figure 1: Red Box Energy Services’ heavylift deck cargo ship Audax at Grenaa, Denmark, loading a jack-up rig on its stern.

Photo: Red Box Energy Services Pte. Ltd.