Offshore oil and gas market stabilising

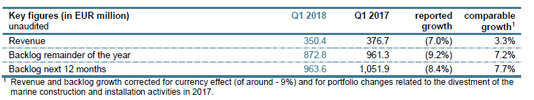

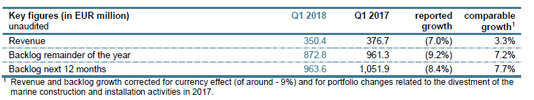

• Year-on-year revenue grew 3.3% on a comparable basis; this first increase after 12 quarters reflects a stabilising offshore oil and gas market.

• EBIT improved from a high-single digit to mid-single digit negative margin in seasonally weak first quarter, mainly as a result of lower depreciation and cost reductions.

• Cash flow from operating activities after investments was negative, mostly due to increased working capital.

• Net debt/EBITDA of 2.5; expected to improve towards year-end.

• Backlog for the next 12 months increased by 7.7% on a comparable basis year-on-year.

• Outlook 2018: After three years of sharp revenue decline Fugro expects revenue growth on a comparable basis, an improved EBIT margin and positive cash flow from operating activities after investments.

Paul van Riel, CEO: “After three years of dealing with a strongly contracting offshore oil and gas market, we are pleased to report an increase in our activity level. Supported by the measures taken last year, results improved, but limited as we are still working on low margin contracts which were secured at the bottom of the market.

The non-oil and gas markets that are relevant for Fugro, mostly building & infrastructure and offshore wind, continue to develop positively. Especially in offshore wind, Fugro benefits from the plans for large developments in the North Sea and elsewhere. In the offshore oil and gas market, the clear increase in the number of sanctioned projects indicates that we are at an inflection point. Currently we are still facing oversupply and a strongly competitive environment, but we are achieving some price recovery in selected markets. We continue to focus on price improvement, cost control and positive cash flow generation.”